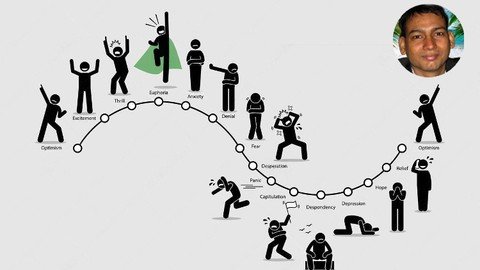

Psychology Of Stock Trading Behavioural Finance

Free Download Psychology Of Stock Trading Behavioural Finance

Last updated 2/2024

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 2.13 GB | Duration: 3h 29m

Learn to master your emotions for stock market

What you'll learn

Understand the key concepts and principles of behavioural finance and its relevance to the stock market

Understand the role of emotions in investment decisions and develop strategies to manage them.

Identify the various cognitive biases that can affect investment decisions and develop strategies to overcome them.

Analyze real-world examples and case studies to understand the impact of behavioural finance on stock market investing.

Apply behavioural finance tools and techniques to improve investment decision-making.

Identify common mistakes people make in the Stock Market

Requirements

Basic knowledge of the stock market and investment principles

Description

"The Greatest Enemies of Equity Investors are Expenses and Emotions." - Warren BuffettWe are blind to our blindness. We have very little idea about how little we know about life & especially about ourselves.Unlock the secrets of successful trading by delving into the fascinating world of trading psychology. This comprehensive course is designed to equip you with the knowledge and skills to understand and overcome the psychological barriers that often hinder traders from reaching their full potential. Through a deep exploration of the human mind and emotions, you will gain valuable insights into how our decision-making processes and biases can impact our trading outcomes.The course begins with an exploration of how the brain processes information and relies on mental shortcuts, which can lead to fast but occasionally inaccurate decisions. You will uncover the intricate relationship between emotions and human behaviour, examining how emotions such as overconfidence and low self-esteem can become self-sabotaging and self-destructive in the trading arena. Additionally, you will discover the powerful influence of emotions like fear and greed on market dynamics, enabling you to navigate these forces with greater awareness.Understanding the importance of probabilities and the impact of sample size bias is crucial for making informed trading decisions. You will explore Prospect Theory, Loss Aversion, and Risk-Seeking behaviour, gaining valuable insights into how individuals make choices under uncertainty. In-depth analyses of common cognitive biases prevalent in the stock market, including availability, anchoring, familiarity, confirmation, and hindsight biases, will equip you with the tools to recognize and mitigate irrational behaviours.Moreover, you will delve into the role of uncertainty and randomness in life and learn how to navigate their impact effectively. The course sheds light on the detrimental effects of overconfidence, confirmation bias, and mental accounting in trading, enabling you to make more balanced and objective decisions. You will also challenge the notion of experts in the trading world, exploring the framing effect and debunking the "expert myth."Drawing a clear distinction between trading and investment, you will learn how to avoid the pitfalls of mixing the two and gain a realistic understanding of the challenges associated with trading. By examining the profile of a successful trader, you will gain valuable self-awareness to determine if this career path aligns with your skills and temperament.Emotional education plays a pivotal role in achieving stability and balance in life. You will learn practical strategies for cultivating emotional intelligence and developing systems to handle your emotions and biases effectively. Leveraging insights from behavioural finance, you will discover how to improve your investment decision-making by capitalizing on the interplay between psychology and finance.Finally, you will be encouraged to embrace calculated risk-taking, leveraging your clear edge to optimize trading outcomes. Risk management techniques and principles will be thoroughly explored to ensure you can navigate the volatile world of trading with confidence.By completing this course, you will acquire a comprehensive understanding of trading psychology and behavioural finance, enabling you to approach the markets with a disciplined and informed mindset. Don't miss this opportunity to unlock your full trading potential and gain a competitive edge in the financial world. Enrol now and embark on your journey to becoming a master of trading psychology and behavioural finance.

Overview

Section 1: Human Limitations

Lecture 1 Hi! I am powerless over my Emotions

Lecture 2 Information Processing & Mental Shortcuts

Lecture 3 Brain Hijack: Impact of High Emotions

Lecture 4 Self Esteem , Approval & Risk Addiction

Lecture 5 Social Psychology: Confirmity, Obedience & Pursuation

Lecture 6 The Ultimatum Game

Lecture 7 Emotions & Market

Section 2: Mind Model & Prospect Theory

Lecture 8 Two Systems

Lecture 9 Factfulness

Lecture 10 Intuition

Lecture 11 Probabilities & Base Rate Neglect

Lecture 12 Conjunction Fallacy

Lecture 13 Utility of Money

Lecture 14 Prospect Theory

Lecture 15 Loss Aversion

Lecture 16 Regret Theory

Lecture 17 Certainty Effect

Lecture 18 Possibility Effect

Lecture 19 Prospect theory in Stock Market

Section 3: Common Heuristics & Cognitive Biases

Lecture 20 Introduction to Biases

Lecture 21 The Availability Heuristic

Lecture 22 Representativeness Heuristic

Lecture 23 Randomness of Randomness

Lecture 24 The Anchoring Heuristic

Lecture 25 Hindsight Bias/Perceptual bias

Lecture 26 Halo Effect

Lecture 27 Dedication bias

Lecture 28 Survivorship Bias

Lecture 29 Familiarity Bias

Section 4: Emotions and the Stock Market

Lecture 30 Overconfidence

Lecture 31 Correlation and Causation

Lecture 32 Confirmation Bias

Lecture 33 Mental Accounting

Lecture 34 House Money Effect

Lecture 35 Sample Size Bias

Section 5: Expert Myth

Lecture 36 Expert Myth

Lecture 37 Framing Effect

Lecture 38 Best Sales Pitch

Lecture 39 Roast of a Stock Market Expert

Section 6: Now about Trading

Lecture 40 Trading vs Investment

Lecture 41 Issues with Trading

Lecture 42 A few words on Derivatives

Lecture 43 Leverage & Trading Costs

Lecture 44 Profile of a Successful Trader

Section 7: Trading Systems

Lecture 45 Trading System Example

Traders: who want to better understand the psychological factors that drive stock market trends and develop strategies to trade more effectively.,Investors: Individuals who are interested in investing in the stock market, whether as beginners or experienced investors, and want to improve their decision-making process using behavioural finance concepts.,Financial Advisors: Who want to expand their knowledge of behavioural finance to better serve their clients,Investment Analysts: Investment analysts who want to deepen their understanding of behavioural finance,Business Students: Business students who are interested in finance, psychology, or behavioural economics and want to gain a deeper understanding of how these fields intersect in the stock market.

Homepage

https://www.udemy.com/course/psychology-of-stock-trading-behavioural-finance/Rapidgator

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part3.rar.html

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part2.rar.html

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part1.rar.html

Fikper Free Links

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part2.rar.html

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part1.rar.html

jwvbl.Psychology.Of.Stock.Trading.Behavioural.Finance.part3.rar.html

No Password - Links are Interchangeable